Silver Stock Report

by Jason Hommel, December 21, 2005

It’s always easy to make investment decisions in hindsight. It’s much harder to have a vision for the future. I believe that paper money will be destroyed, and that gold and silver money will once again be restored as money worldwide. And I will share my vision with you, based on fundamentals, and presented, in the form of graphs of gold and silver prices in the future, as denominated in increasingly worthless dollars.

On Dec. 13, I sent out an email titled, “Should I wait for a correction to buy silver?”

http://www.silverstockreport.com/email/correction.html

In sum, no, I wouldn’t advise anyone to wait to buy. The reason is my very high expectation for silver and gold prices in the future. If silver is headed above $200/oz., it does not really matter too much if you buy silver at $8 or $9–it is far more important to actually have silver, and sell paper money, before the price of precious metals begins to really skyrocket.

Furthermore, silver can move up dramatically AT ANY TIME! Why? Because the remaining silver supplies, (less than 130 million oz. of refined silver) are valued at about $1 billion. And yet, there are relatively massive amounts of money ($22 trillion bond market, $10 trillion money in the banks [M3], $10 trillion worth of yen, $2.6 trillion dollars in Asia) that need the protection of a good investment, like silver.

See: Silver Users Fear Silver Shortage

http://biz.yahoo.com/prnews/051027/clth528.html?.v=8

AT ANY TIME, a billionaire, and there are over 600 of them, could buy some silver, and push the price up beyond $25/oz., and silver would still be cheap.

In my speeches at the mining shows, I have spoken of the fundamentals (like I just did). I usually then say that I don’t like or do any technical analysis. Most chartists, in my opinion, over analyze the past dollar/gold price movements on the charts to try and predict a future dollar/gold price by the application of drawing lines or shapes or parabolas on charts to determine “the trend” or “the channel”. But the chart contains absolutely zero information on the number one fundamental issue that will control the dollar price of silver and gold, namely, the charts do not tell you how many dollars they have created to excess! More and more dollar owners, one after another, will realize the fundamental truth, that paper is not real money, but only gold and silver are real money. The paper stuff may be money, but it is fraudulent money, and the fundamental, undeniable, and inescapable truth is that all frauds become exposed, and once exposed, they come to an abrupt end!

From 1971 until 1980, gold increased from $35/oz. to $850/oz. That was an increase of about 24 times, or, if you average out the gains from the bottom to the peak, an annual increase of 34%, for ten years straight. Thus, it took nearly 10 years to work off only some of the excess creation of paper money (inflation) that existed in the system since 1933, from the previous gold default, when gold was initially re-priced and fixed at $35/oz. from $20/oz. But the 1980 peak did not work out all the paper excesses–if it did, gold would have reached about $7000/oz., as you can see on the chart below. If all the paper excesses are worked off next time, we may expect the U.S. gold hoard to be equal to the money in U.S. banks, which would imply a price of about $38,314/oz. To get that number, simply divide the current $10 trillion in the banks (M3–soon to be discontinued) by the 261 million oz. of “official” gold, which may not even exist. Ahem!

I first discussed this concept in two articles here:

Why no talk of $32,567/oz ? – 02 January 2003

http://www.silverstockreport.com/essays/Why_no_talk_of_32567_oz_-.html

People Talking About $32,567/oz – 10 January 2003

http://www.silverstockreport.com/essays/People_Talking_About_32567_oz.html

So, instead of doing technical analysis to determine future gold prices, let’s graph those fundamentals I just discussed. Here’s the M3 / U.S. gold chart, showing what the gold price would have been if the money creation showed up instantly in the gold price, every time a dollar is created. Clearly, there is delay between the time of money creation, and when this fraud is revealed.

Official government sources:

Source of M3 http://www.federalreserve.gov/releases/h6/Current/

Source of U.S. Gold http://www.fms.treas.gov/gold/index.html

To get to about $40,000/oz. for gold, to catch up to all that past inflation, we would need a growth rate of about 30% per year, starting about now in 2006, for about 15 years. Of course, it could happen sooner. But let’s look at that on a graph, shall we? The graph will illustrate how utterly useless it is to dwell excessively on the relatively minor price movements in gold and silver that we see today. Note the flat line at the bottom, showing a tiny blip around 1980. The historical ups and downs that we are seeing on today’s price charts, under the scenario I expect in the future, will be reduced to nearly nothing.

Yes, that looks very dramatic. Is it possible? Of course, and the next chart shows that this expectation is actually far too conservative. Here’s the same information, on a log chart, instead of a linear chart. On a log chart, each “line up” increase is a multiple. Note, a compound growth rate on a log chart appears as a straight line, and not a curve. Note, in the 1970’s, the moves up were even steeper than this particular “prediction”.

I realize that this “line” is not how markets behave. There will be ups and downs, violent ones, along the way. But I just don’t have any ability to predict such short-term price trends. I only see the long trend. Nothing moves up in a straight line!

And yet, this prediction of $40,000/oz. gold is conservative for the following reasons.

1. As noted, my expected “line” is less steep than the rise of gold in the early 70’s and late 70’s. And the fundamentals actually point to a much steeper rise in the future than we experienced in the 70’s.

2. It does not take into account any additional inflation (paper money creation) that will likely take place between 2005 and 2020. Yes, that’s right, $40,000/oz. could happen if they stopped all money creation today, and for the next 15 years. But with Bernanke at the helm of the Fed, we will see massive continued inflation.

3. It does not take into account the vast amounts of money in the bond markets, (which is also money) and a competing investment with gold.

4. It does not take into account that many other nations have paper money, both U.S. dollars and their own currencies, that they will want to sell to buy gold, thus creating a worldwide bull market in gold prices.

5. It does not take into account human behavior, which is that people will move into gold more and more as the fraud of paper dollars and the entire dollar system continues to be exposed. Also, as gold moves up, more and more people will recognize the trend of gold is up, since 30% annual returns (the conservative figure) are hard to ignore.

6. It does not take into account that the dollar could actually go to its intrinsic value (of slightly over zero), which is that pre-printed paper (money) is worth about the same as scrap paper, such as used newspapers.

So, taking those factors into account, gold could rise to $100,000/oz. if we account for most bond money moving into gold. Further, gold could rise to $1,000,000/oz. if we assume that the money supply will rise another ten fold in the next 15 years. Further, gold could rise to well beyond a million dollars an oz. if we assume people will be driven by mass psychology. And finally, gold could rise to infinity dollars if dollars will not purchase any gold at all.

Surprisingly, the next chart, taking nearly everything into account, does not look too much different than the previous one. The major difference appears to be only the final price, but it’s that low only because you can’t really design a graph that takes the dollar gold price to infinity dollars per oz., implying that dollars become utterly worthless. So, even the next chart is conservative, because gold could rise higher, and sooner than the following if the dollar dies sooner than 15 years from now.

I think it is rather important to note that these are not really true growth rates. They are actually decay rates. They show the dollar decaying. Gold’s value cannot grow to infinity, but a dollar’s value can decay away to nothing. So, I’m not saying that gold will have infinite value. I’m saying dollars will become worthless.

An oz. of gold, when it becomes widely used as money again, will probably have a value similar to what it had in historic times. An oz. of gold may be worth about a year’s salary for a clerk, or may buy a modest home, and will be far, far too expensive for the average man to even have one ounce of gold. And therefore, for most monetary transactions (less than the modern equivalent of $40,000/oz.) we will need silver.

Silver

Due to the apparently impending silver shortage, Ted Butler at http://www.butlerresearch.com believes that silver will never be able to be used as money again, because silver will be too rare and too valuable. (I know, because I’ve asked him.) I think this is unrealistic, because you can always divide silver (or gold) into smaller and smaller pieces. It may be that a gram (1 troy ounce = 31.1034768 grams) of silver will be worth the modern equivalent of about $100-$200, and that could be achieved through electronic banking such as e-gold, or goldmoney, or E-silver! And for physical transactions smaller than that, copper could be a suitable substitute. This would imply a price of $3110/oz. -$6220/oz. for silver.

I respect Ted Butler a great deal, but there is one other key point about silver that I think he sometimes misses. Since he analyses silver mostly as a commodity and not money, I think he forgets that monetary demand for silver can increase as silver and gold prices rise. Rising prices will not reduce demand for silver, rising prices can create increased investment and monetary demand (because investors seek out returns, and because investors like to escape losses in devaluing dollars.)

I can understand why Ted Butler may not see things this way, since it is a difficult concept to understand, and not really even taught in economics. In economic theory, there are two terms, “Veblen good” and “Giffen good”, both of which describe an item that “may theoretically exist” that people may want more of as the price rises. I believe gold and silver will be listed in the descriptions of “Veblen good” and “Giffen good”, years from now, perhaps during the major bull move up in precious metals.

So, I actually expect that silver could reach a ratio of 5:1 to gold, due to the shortage of silver, and increasingly high investment demand for both metals in general. In that case, 5 ounces of silver would be worth a year’s salary, or a modest home, or about 1/5th of today’s $40,000, or about $8000 of today’s money (not counting future inflation.) In such a scenario, I would expect that the silver miners would have the most profitable businesses in the world, as was the case:

As the New York Times, January 11, 1859, page 2 said—

“It is well known that the most colossal fortunes the world ever saw have been based on silver mines in Mexico.”

–quote found by Charles Savoie

There are simply too many doomers and gloomers who think that if gold and silver go up, it will be bad for the economy–because that’s what we’ve been taught by the central bankers who run everything. But that’s nonsense! A high silver price creates wealth, but not for bankers, but for mine owners! Gold is a pure luxury item. How could it possibly hurt the average man if it’s price goes up? Ask yourself, who would be hurt by higher gold prices? Only bankers, paper money counterfeiters, and gold debtors!

Today, many are concerned by higher commodity prices, as if China somehow will continue to devour all the copper on earth. Today, silver is produced as a byproduct of copper mining. Historically however, copper was produced as a byproduct of silver mining! If silver goes to the modern price equivalent of $8000/oz., it will not necessarily “collapse society” or “kill trade”, or cause “mass violence”. On the contrary, super high silver prices will spur a mining boom, which will create plenty of high paying mining jobs, and will produce an abundance of excess copper (and lead and zinc) in the process!

See: Rising Gold Prices Will Help The Economy – 02 December 2003

http://www.silverstockreport.com/essays/Rising_Gold_Prices_will_help_the_Economy.html

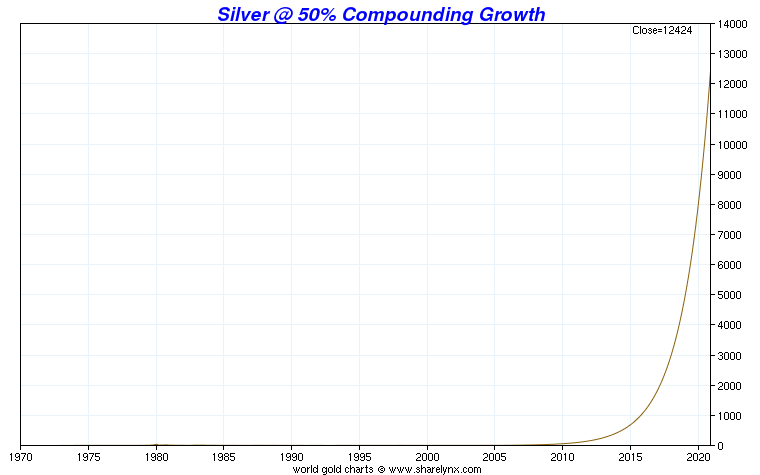

And after a generation, perhaps, of a silver mining boom, silver prices may drop back down to the historical ratio of about 15:1 or 10:1 to gold. But now it’s time to see silver rise to about $8000/oz. on a chart! This is a linear chart, showing silver compounding at 50% annually, starting in about 2006. Interestingly, you can’t even see silver prices begin to rise on the chart until about 2010!

Do not wait until after silver starts compounding at 50% per year for 5 years in a row to start investing in silver! No, rather, you should start investing as early as possible, and you should not really care whether silver is $7/oz., or $9/oz. or even $25/oz. Anything under $100/oz. is probably a bargain for silver.

Now, before you email me to tell me that I’m crazy, please consider four things:

First, Asian central banks have $2.6 trillion U.S. dollar reserves, just in central banks, not including private dollar ownership, and not including their own paper wealth. At $500/oz., all the gold in all the world is valued at $2.5 trillion dollars, and the annual trading volume of gold is about $80 billion. If anything like 1/26th of Asian central bank dollar reserves tries to buy into the gold market, physical trading volumes will double. About 5000 tonnes of new buying will completely overwhelm a 5000 tonne annual market that is manipulated to the downside by the selling and leasing of about 1500 tonnes of central bank gold per year.

See: Central Banks now buying Gold

http://www.silverstockreport.com/email/dec8th.html

Second, every paper currency that was ever printed in the history of the world eventually was devalued all the way to zero. Ask yourself: Are you are 100% sure that it cannot, ever, happen to the dollar? And ask yourself if the cost of making war on all of Asia, to defend the dollar and prevent all people everywhere in the world from buying gold, is really feasible? And if the U.S. printed up money to pay for such wars, wouldn’t that destroy the currency even faster?

Third, what would happen if interest rates were raised to above 30%, to provide the kind of returns that would actually compete with gold’s returns–to entice people to sell gold for bonds? Even though the paper printing masters can print paper fast enough to pay off such loans, wouldn’t that kind of inflation just drive people away from the dollar even faster?

Fourth, if you are afraid that gold is going to rise, why not buy gold?

As for me, I’m not afraid of gold or silver rising, nor am I greedy for it. I’m just confident it will happen, because there are many fundamental differences between paper money, and gold. You can read about that in the first section of my e-book:

10 Reasons why it’s always good to own gold (gold is money & why it is money).

http://www.silverstockreport.com/ebook.htm

One comment

Comments are closed.